All Things Credit

Welcome to the ‘All Things Credit’ series, where we unpack the essentials of credit. From credit cards to loans and everything in between, we'll help you make responsible and informed credit decisions with our wide range of videos.

We will offer knowledgeable insights on the different loan types, important terms, key things to remember, and other essential tips. Diving further, you will learn about Personal Loans, Home Loans, Gold Loans, Loan Against Property, Two-wheeler Loans, etc.

Our videos will also explore the intricacies of wisely choosing, using, and boosting the benefits of your credit cards. Similarly, you will learn more about the nitty-gritties of your credit score and report. Here, we will try to reveal the secrets of a good score, why it matters, and how to improve it.

Finally, we will explore the world of digital lending, where we examine the rise of online lending platforms, their convenience, and potential risks. Overall, these informative videos could empower you to navigate credit confidently and wisely.

12 Seasons

Season

Credit Card Story

Welcome to Credit Card Story! This season takes you on an exciting journey into the world of plastic money. We’ll break down the different types of credit cards, guiding you to choose one that aligns with your lifestyle and financial goals. Join us as we uncover how to use credit cards wisely, avoid debt, and maximise rewards and benefits. We’ll also explore important aspects like grace periods, cash advances, and student-friendly credit cards. Additionally, you’ll learn how credit differs from debit and how UPI could fit into your credit card payments. This season delves into everything from building credit to optimising spending, with actionable insights at every step. Whether you’re new to credit cards or looking to refine your strategy, Credit Card Story might help you make informed decisions on your financial journey.

Start Watching

Bites

Season

Loans 101

Welcome to Loans 101! This season takes you on a comprehensive journey through the intricate world of borrowing, designed to simplify loans and support your financial goals. We’ll break down various loan types, including personal loans, home loans, etc. that might help you understand which options suit your needs. Join us as we unpack essential terms every borrower should know and explore strategies for managing multiple loans effectively. You’ll learn how to maximise tax benefits, stay on top of repayments, and navigate common challenges like loan defaults. We’ll also demystify the difference between pre-approved and pre-qualified offers, that could ensure clarity in your borrowing journey. Whether you’re a first-time borrower or looking to optimise existing loans, Loans 101 could offer practical insights and tips. This season might empower you to make informed decisions and take confident steps toward financial control.

Start Watching

Bites

Season

Personal Loan Story

Welcome to Personal Loan Story! This season walks you through the personal loan journey, from understanding the basics to mastering repayment strategies. You’ll learn how to choose the right loan, calculate payments, and leverage features like overdraft facilities to optimise your borrowing experience. Join us as we discover practical tips to help you secure the right deals, avoid common mistakes, and repay your loan efficiently. Along the way, we’ll explore advanced topics such as refinancing, debt consolidation, and ways to reduce overall interest costs. Whether you’re a novice at borrowing or looking to refine your financial approach, Personal Loan Story could offer valuable insights that might support informed decisions. This season aims to empower you with the knowledge and confidence to make the most of your personal loan, no matter where you are on your financial journey.

Start Watching

Bites

Season

Loans for Homes

Welcome to Loans for Homes! This season takes you through the essential steps to turn your dream of homeownership into reality. We’ll break down key aspects of home loans, from understanding various loan types to making informed choices between fixed and floating interest rates. Join us as we explore strategies for first-time buyers, the importance of down payments, and how to make the most of tools like home loan calculators. You’ll also gain insights into government schemes, financing for under-construction properties, and often-overlooked details like reset clauses. This season goes beyond the basics, uncovering ways you might save on your loan, be it through prepayment strategies or interest reduction techniques. Packed with actionable insights, Loans for Homes could empower you with the confidence you need to step into your dream home journey.

Start Watching

Bites

Season

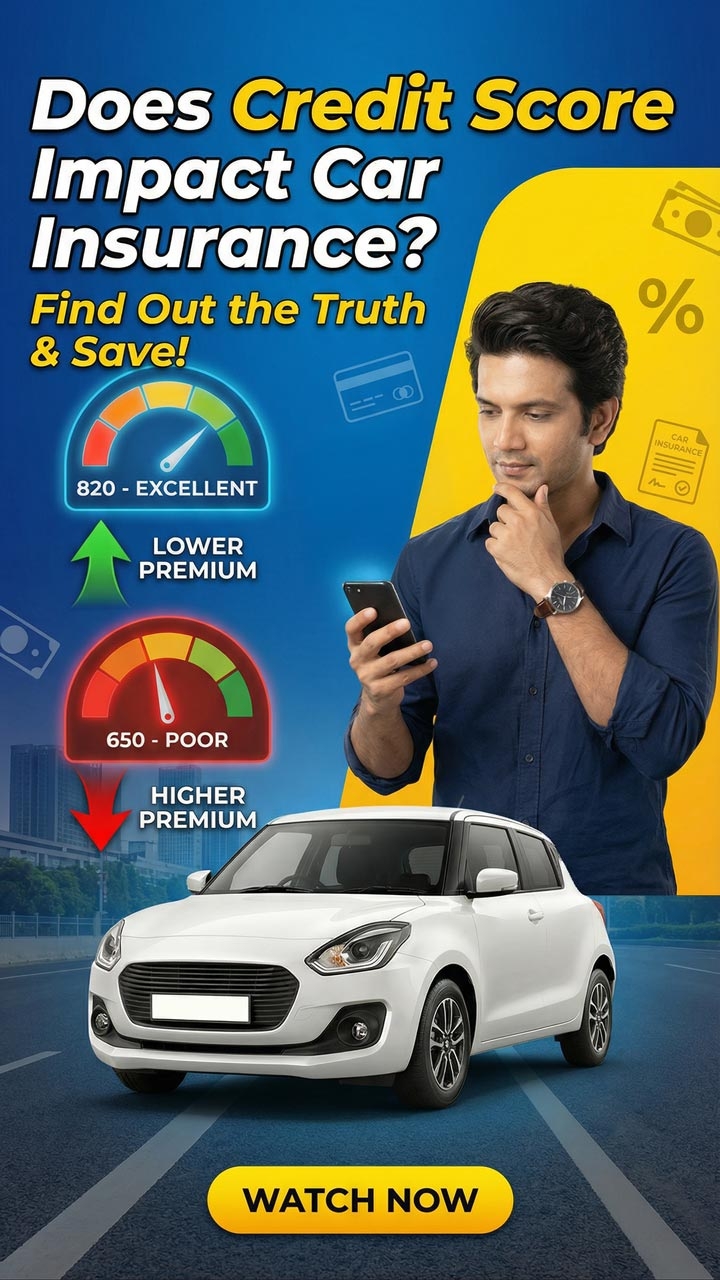

Credit Score 101

Welcome to Credit Score 101, where we’ll unravel the mysteries behind those all-important numbers. In this season, you’ll discover how credit scores might shape key financial decisions, from loan approvals to housing options. We’ll also decode numbers, simplify credit jargon, and how you could take charge of your financial well-being. Join us as we explore strategies for building credit from scratch, boosting your score quickly, and avoiding common credit mistakes. You’ll gain a deeper understanding of how financial habits could impact your overall financial health and uncover the truth behind widespread credit myths. Whether you’re working towards securing a loan or aiming to safeguard your financial future, Credit Score 101 could offer actionable insights. This could help you find your way through the credit landscape with ease and make better financial decisions.

Start Watching

Bites

Season

Digital Lending

Welcome to Digital Lending! Join us as we delve into the fast-evolving world of online loans and digital lending platforms. This season covers key topics in the world of digital loan, from their benefits to the potential risks. We’ll begin by introducing digital lending platforms, highlighting their convenience and accessibility. Next, you can learn about the advantages and possible downsides of digital loans, along with their impact on your financial health. Our videos also cover cutting-edge innovations in digital lending technology and their impact on borrowing. Here, you can stay informed about digital loan scams and fraud and get practical tips on protecting yourself. Our videos also explore consumer rights, legal protections, and the social impact of digital lending. Overall, these can equip you with knowledge of your rights, boost your financial literacy, and promote responsible borrowing. So, set off on this journey to learn about all the aspects of digital lending and make informed decisions about your money management.

Start Watching

Bites

Season

LAP and LAPBT

Welcome to LAP & LAPBT! Yep, you guessed it, here we will walk you through the workings of a Loan Against Property & its Balance Transfer! Get ready to learn about the essential aspects of LAP, understand its benefits, requirements, and best practices for balance transfers. We start with the basics of LAP and the property types accepted for it. You will also understand how loan amounts and EMIs are calculated. We will also explore the importance of insurance in securing your loan. Our videos will also offer insights into the tax implications of LAP, as well as the latest government policies and regulations. Coming to balance transfers, you will get to learn its advantages and how to avoid common pitfalls when switching lenders. We will also explore related topics like interest rates, tenure options, eligibility criteria, required documentation, and more. Finally, you will understand how LAP compares to other products like personal loans. So, start watching and become a pro at leveraging your property for various financial needs!

Start Watching

Bites

Season

All About Two Wheeler Loans

Welcome to All About Two-Wheeler Loans! These videos could help you understand everything about financing your bike purchase with confidence. From eligibility to EMI calculations, we will try to cover all aspects of managing your two-wheeler loan. Let’s start with an overview of the key things you need to know about two-wheeler loans. This could ensure you’re informed on terms, interest rates, and application essentials. Next, our EMI Calculator video could show you how to estimate your monthly payments accurately and plan your budget accordingly. Next, you could learn how to check your loan eligibility, so you know where you stand before applying. We also explain the processes of part-payment and foreclosure, helping you make the most of flexible repayment options. Finally, we’ll help clarify your responsibilities with ongoing EMIs and what to expect if your bike is stolen or completely damaged. So, boost your practical knowledge to manage your two-wheeler loan, so you can focus on enjoying your ride with peace of mind.

Start Watching

Season

The Gold Loan Affair

Welcome to The Gold Loan Affair, your gateway to leveraging the value of your gold assets. In this season, we’ll unpack how gold loans might provide a swift and dependable way to meet financial needs. This could offer fast access to funds with minimal paperwork. We’ll walk you through the essentials, including eligibility criteria and the necessary documentation to secure a loan. You’ll discover effective strategies for managing repayments and keeping your finances on track. You’ll also get acquainted with the gold loan calculator, a handy tool that could help you estimate loan amounts and plan repayments. Furthermore, we’ll share insights on how you could maximise the benefits of your gold loan, turning it into a powerful financial resource. Whether you’re in need of quick liquidity or exploring flexible funding options, The Gold Loan Affair could assist you in making well-informed decisions.

Start Watching

Bites

Season

The Education Loan Digest

Welcome to The Education Loan Digest! This season takes you on a comprehensive journey through the realm of education loans. We’ll explore every aspect of funding your education, from choosing between secured and unsecured loans to understanding eligibility criteria. Join us as we unravel how to improve your chances of approval, leverage tax benefits, and navigate the impact of your credit score. Get clarity on crucial concepts like moratorium periods, repayment plans, and the possibility of obtaining loans without a guarantor. This season will also shed light on essential factors like education loan waivers, the risks of common mistakes, and myths that could mislead you. Gain practical strategies that could help you manage your education loans and make informed decisions about your academic future. Gear up for a deep dive into the world of education loans!

Start Watching

Bites

Season

Unlocking Used Car Loans

Dive into the world of second-hand car financing with “Unlocking Used Car Loans”. This comprehensive collection of videos covers every crucial aspect of second-hand car loans to help you make informed decisions. First, we start with the essentials of used car loans, providing you with a detailed overview of the basics. Then, we’ll dive deeper into quick, focused topics like eligibility criteria, key factors to consider, and common mistakes to avoid. Next, our videos will help you explore niche topics such as financing used electric vehicles. We’ll also discuss handling second-hand car loans with low credit scores, and understanding how a car’s age could impact your loan terms. Finally, the series also tackles myths about second-hand car loans and tax benefits. Here, you’ll also learn how these loans differ from new car financing. Whether you're a first-time buyer or an experienced car owner, this set of videos has something insightful for everyone.

Start Watching

Bites

Season

The Business Loan Blueprint

Welcome to The Business Loan Blueprint! This season takes you on a well-rounded exploration of the intricate world of business loans. We’ll explore the diverse options available in the Indian market, from working capital loans to term loans and overdrafts. Join the ride as we learn what lenders look for in applications, how to navigate the loan process, and repayment strategies for business needs. Discover how businesses manage cash flow effectively and the role of start-up loans in fostering entrepreneurial growth, especially for women. Unravel myths, identify hurdles, and avoid common mistakes that might hinder your loan approval. This season offers insights into crucial topics like tax deductibility of EMIs, challenges in applications, and practical strategies to streamline your financing journey. Prepare to harness the potential of business loans and take your venture to new heights!

Start Watching

Bites

_Balance_Transfer.jpg)

_Balance_Transfer.jpg)

.png)