Money Management and Financial Planning

Welcome to Money Management and Financial Planning, where essential money managing skills pave the way to financial freedom. In this series, we’ll immerse in the fundamentals of budgeting, saving, and making wise financial decisions across various life stages and scenarios.

We’ll cover practical financial insights tailored to everyday needs from mastering the art of budgeting and saving to purchasing your first car or home. We’ll explore effective strategies for family budgeting, funding education, and planning for major events like weddings. We’ll also break down the Union Budget, highlighting tax reforms, employment schemes, and their impact on your finances.

Additionally, you’ll gain valuable knowledge on navigating career changes, preparing for economic downturns, and building robust financial safety nets. Whether it’s understanding personal finance principles or decoding complex budgeting methods, this series might offer the tools to elevate your financial management skills.

5 Seasons

Season

Foundation of Financial Literacy

Welcome to Foundation of Financial Literacy, where practical knowledge meets real-life application. In this season, we’ll delve into the core principles of personal finance that might empower you to make informed money decisions. We’ll begin with the fundamentals of budgeting and saving, exploring how to master your monthly finances. You’ll gain insights into buying your first car and navigating the complexities of homeownership. Life’s milestones like planning a wedding or funding a college education will also be covered, providing you with actionable steps to stay financially prepared. Additionally, we’ll tackle important topics such as managing family expenses, adapting your finances during career transitions, and safeguarding your wealth during economic downturns. With this season as your financial compass, you might be better equipped to lay the groundwork for financial well-being and turn your goals into reality.

Start Watching

Bites

Season

Advanced Financial Strategies

Welcome to Advanced Financial Strategies, where we decode complex financial concepts and unveil tools that could help you take control of your money. In this season, we’ll look into advanced budgeting frameworks and techniques that might help you optimise your financial health for long-term success. We’ll explore diverse money management methods like the 30:40:30 rule, 50:30:20 rule and other budgeting formulas designed to balance savings, spending, and investments. Our videos will also unpack practical strategies for managing everyday expenses, such as dining choices and creating tailored emergency funds for medical needs or unexpected repairs. Additionally, this season highlights estate planning and how understanding your psychological approach to money might influence your financial decisions. Whether you’re aiming to strike a financial balance or preparing for unexpected challenges, Advanced Financial Strategies could assist you in making impactful financial decisions.

Start Watching

Bites

Season

Understanding the Union Budget 2024

Welcome to Understanding the Union Budget 2024! Join us as we break down the key highlights and impacts of this year’s budget in an easy-to-understand manner. These videos could provide insights into how the budget affects individuals, businesses, and various sectors across India. We start with a concise summary of the budget in under five minutes, giving you a quick overview of the major announcements. Dive deeper as we decode the budget’s impact on taxpayers, employment schemes, and financial opportunities. Our videos also focus on start-ups and MSMEs, outlining the policies and incentives tailored for their growth. The videos also explore key tax reforms, including changes in tax regimes and the scrapping of indexation benefits. After that, we’ll discuss the allocations announced for education, skill development, and tourism, showcasing the government’s focus on widespread growth. With these videos, you could gain a clear understanding of the Union Budget 2024 and how it can shape India’s economic future.

Start Watching

Bites

Season

Understanding the Union Budget 2025

Welcome to Understanding the Union Budget 2025! This season dives into the key announcements, policies, and financial changes that could impact your life. From tax updates to sector-specific reforms, we’ll break down everything you need to know. Hop along as we take a closer look at how the latest budget might influence personal finances, business opportunities, and economic growth. Uncover changes in education policies that could reshape learning and skill development. If travel is on your mind, find out how new initiatives might shape the tourism industry. This season brings you a quick snapshot of the biggest takeaways, including taxation updates, exemptions, and policy shifts. Learn how revised income tax rules might influence earnings and deductions. Understand how changes in TDS and TCS regulations could affect transactions and financial planning. Get ready to navigate the numbers, decode the policies, and see what the Union Budget 2025 could mean for you!

Start Watching

Bites

Season

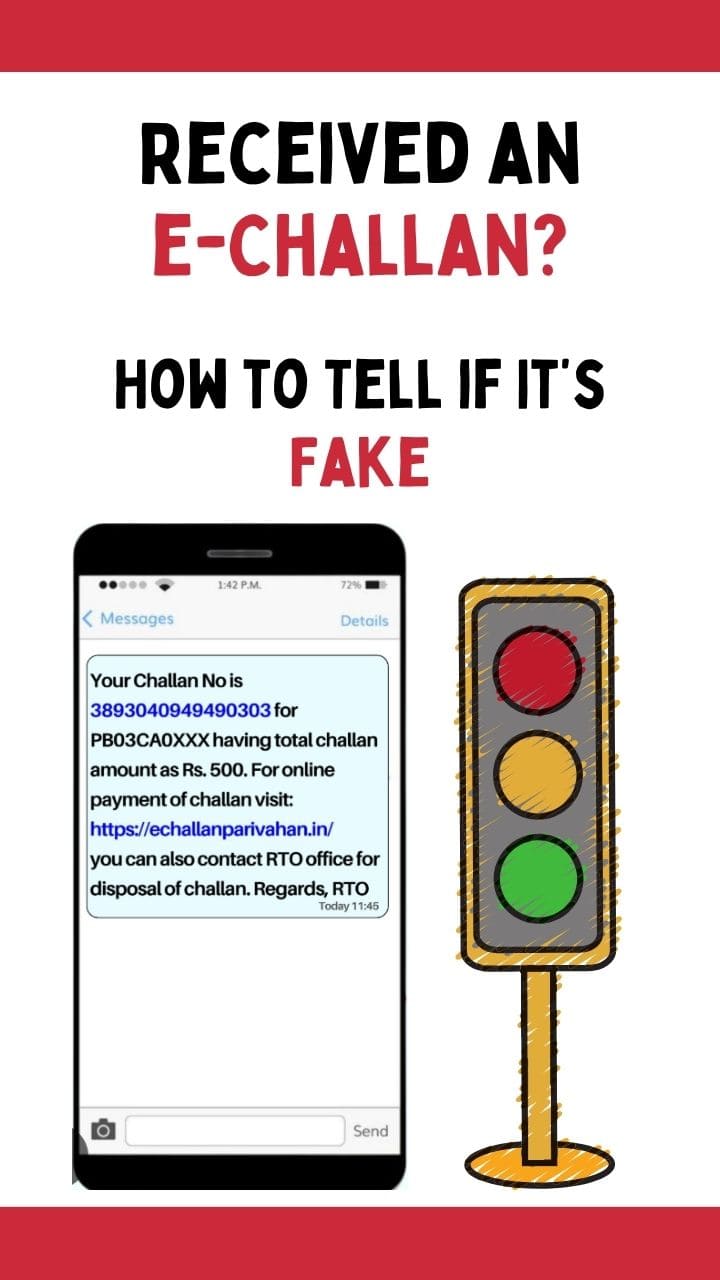

Unmasking Digital Frauds

The digital world offers convenience, but it also brings new dangers. This curated collection of videos uncovers the most common and emerging digital frauds along with preventive tips. Are you prepared to defend yourself? We’ll understand how scammers are evolving, using advanced techniques to steal money and personal information. From fake job offers to AI-driven frauds, digital scams are becoming more common as well as harder to detect. You’ll know about UPI refund scams, SIM hijacking, fake e-challan alerts, subscription renewal traps and more. Through these videos, you can learn how fraudsters use fear, urgency, and technology to manipulate victims. Discover the warning signs of job scams, digital arrest threats, and even AI-generated frauds that can mimic others’ identities. With detailed breakdowns and useful tips, these long and short videos can help you recognise scams before they happen. Ready to stay informed and take control of your online safety? Start watching, decode these frauds, and protect yourself from falling victim.

Start Watching

Bites