The Credit Score Cheat Sheet: Quick Tips for Instant Improvement

Welcome to another episode on understanding your credit score! In this video, we’re sharing essential tips to boost your credit score and improve your financial well-being for various life goals.

First, we’ll cover the importance of knowing your credit score. Regularly check your credit report on platforms like Bajaj Markets or your bank's online portal. This could help you stay informed about your credit standing and knowing which areas need improvement. Next, we explore how paying your bills on time is essential. Setting up automatic payments or reminders ensures that you stay consistent, building reliability in the eyes of lenders.

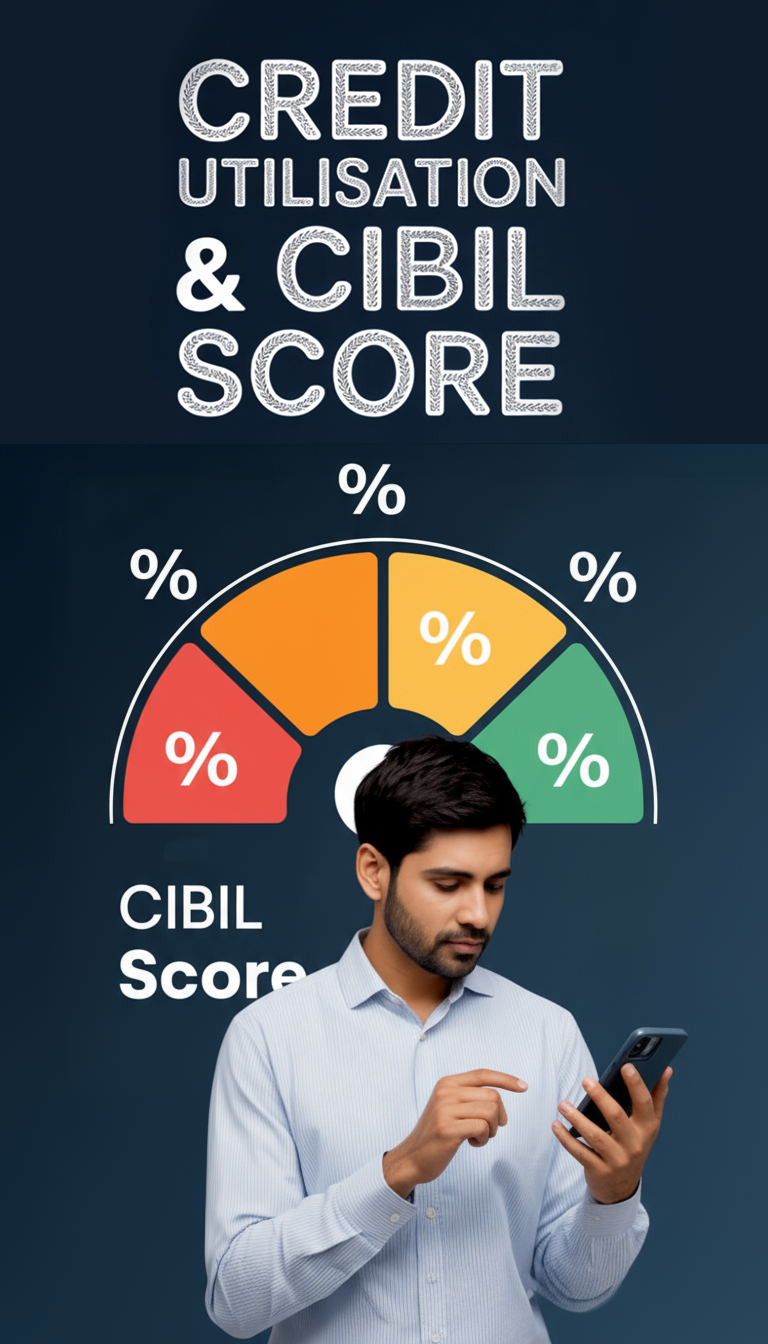

Let’s also discuss reducing credit card balances. After all, a lower credit utilization ratio – ideally below 30% – could positively impact your score. Focusing on high-interest cards or transferring balances to lower-interest ones could help manage debt effectively. Another crucial tip that you’ll learn about is not closing unused credit accounts. Keeping old accounts open could contribute to your credit history’s length. Finally, we’ll go over the importance of disputing errors in your credit report.

These straightforward steps can set you on the path to a better financial future. Keep tuning in for more tips, and remember, every effort counts in strengthening your financial profile!

Key Takeaways

Check your credit score regularly to understand where you stand financially

Make on-time payments consistently to positively impact your creditworthiness

Aim to keep credit card balances below 30% of your credit limit to maintain a healthy score

Keep old, unused credit accounts open, to maintain a longer credit history

Review your credit report for errors and dispute inaccuracies promptly

Understanding credit report components helps focus on areas for improvement

Set up automatic payments or reminders to avoid missing due dates

Pay off high-interest credit cards first or consider balance transfers for quicker score improvements

What to Watch Next

Bites