All Things Tax

Welcome to the “All Things Tax” series, where we simplify the essentials of tax for every Indian taxpayer. From salaried individuals to the self-employed, our videos can help you make informed tax decisions.

For salaried individuals, we’ll first break down confusing income tax terms, slabs, declarations, and both the tax regimes. The videos will also offer key tips on deductions, exemptions, and investment strategies to smartly plan your taxes.

You’ll also learn about many last-minute tax-saving hacks, from real estate and medical deductions to niche investments and donations. These could help you lower your tax liabilities and save more money.

We will also help you understand the finer details of TDS for salaried individuals. These videos will cover the deduction process, ways to minimise impacts, and claim refunds. Similarly, for self-employed individuals, we will cover the inner workings of TDS on rent, property sales, FDs, and more.

Finally, we will detail down income tax filing, ITR forms, and online filing tips for both salaried and self-employed Indians. Together, this series could empower you to manage your taxes confidently.

6 Seasons

Season

Income Tax 101 Salaried

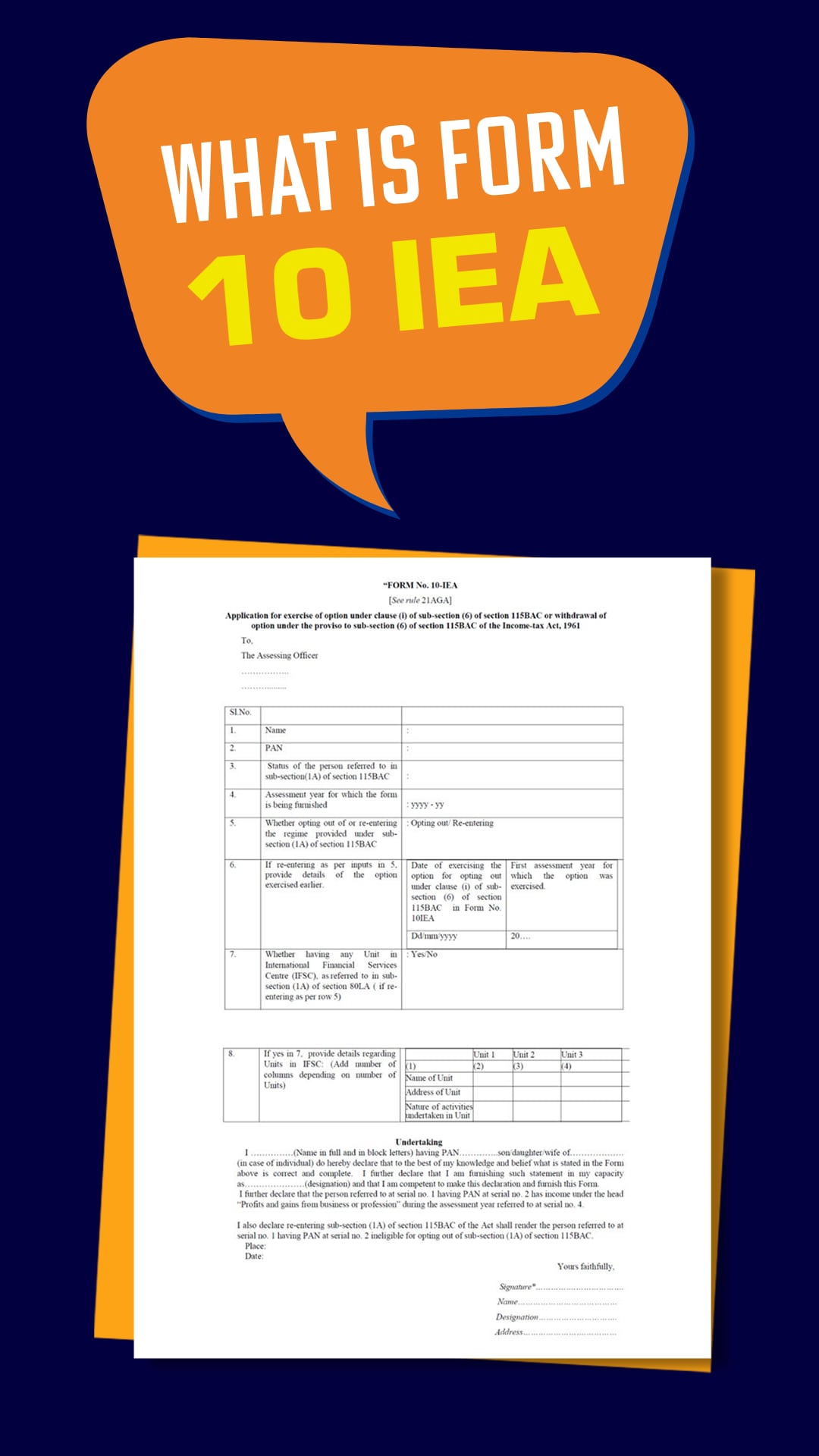

Welcome to Income Tax 101 for Salaried! In this season, we will break down the essentials of income tax for a smooth, stress-free filing experience. From understanding tax terms to filing your ITR, our videos can guide salaried individuals through each step with ease. We start by exploring key tax terms and navigating between the Old and New Tax Regimes, along with an overview of the 2023-24 tax slabs. You’ll also learn about essential declarations needed when filing your ITR to potentially maximise your tax benefits. Speaking of ITR, the videos will also help you distinguish between ITR-1 and ITR-2. Our step-by-step guide could simplify your ITR-1 online filing process to help you avoid common mistakes. You could also get clarity on crucial forms like Form 16, Form 10IEA, Form 26AS, and other ITR forms. Lastly, we will also delve into ITR refunds, explaining why they might be delayed and what you can do. Together, these videos empower you to manage your taxes with confidence and accuracy.

Start Watching

Bites

Season

Income Tax Planning Salaried

Welcome to Income Tax Planning Salaried! Here, we will walk you through the nitty-gritties of income tax, how to save smartly and meet your financial goals. These videos will help to break down tax planning essentials, helping you make the most of available deductions and exemptions. We begin with explaining the objectives and advantages of tax planning. Then you will get to learn how to calculate your taxable income accurately. We’ll also cover how to start planning your taxes effectively and provide insights on why it could be crucial for long-term financial health. Here, you can also know about valuable tax benefits available on education loans and EV loan interest. Similarly, we will offer insights on how charitable and research donations could help reduce your tax burden. Our videos also walk you through deductions available for National Pension Scheme contributions and life insurance premiums. Finally, you could discover tax relief options for disabilities and specified medical treatments. Together, these insights could help you approach your tax planning like a pro!

Start Watching

Bites

Season

Last-Minute Tax Saving Hacks

Welcome to Last-Minute Tax Saving Hacks! With this season, we will try and help you make smart, timely tax-saving moves. When the financial year draws to a close, these videos could help you find effective ways to reduce your taxable income without the last-minute stress. We begin with some eleventh-hour tax-saving investment strategies and tips to avoid common tax-related pitfalls. You can also learn how to calculate your optimal investment amount to invest for maximum savings. We will then discuss potential benefits in property investments and charitable contributions that could make a big impact. From medical expenses to niche investment options, our videos could help you explore lesser-known ways to save on taxes at the end minutes. We’ll cover often-overlooked tax benefits in real estate and donations. Plus, you could find lesser-known ways to maximise your medical-related deductions. With these videos, you might be able to make swift, strategic choices that can help you save on taxes effectively, even when time is almost up.

Start Watching

Bites

Season

TDS for Salaried Individuals

Welcome to TDS for Salaried Individuals! Here, we will try to simplify Tax Deducted at Source (TDS) for working professionals. These videos could offer you a clearer understanding of the basics of TDS, ensuring you stay informed and proactive with your taxes. In our first video, we’ll explain what TDS is, dive into its importance, and discuss ways to check your tax deductions accurately. Next, we will work with some numbers and explore how TDS is calculated on your income. You will also gain useful tips on how to legally minimise its impact and retain more of your earnings. Finally, we will unravel the inner workings of TDS refunds. Here, we will try to cover everything you need to know to claim your TDS refund. Our videos will also help you check your refund status and handle any delays smoothly. With these insights, you could feel ready to tackle your TDS and keep your finances in check.

Start Watching

Season

Income Tax 101 for Self employed

Welcome to Income Tax 101 for Self-employed! These videos are designed to help in making tax filing clear and manageable for all self-employed individuals. We start with an overview of filing your Income Tax Returns (ITR) with a focus on self-employed individuals. You will learn about all the essential steps for a smooth online ITR filing experience. Next, we will discuss the differences between ITR-3 and ITR-4. This could help you choose the right form based on your business structure and income type. Similarly, our videos on key documents required for filing ITR-3 and ITR-4 could help you gather everything you need in advance. This, in turn could make your filing process efficient and error-free. Finally, we will address some common doubts that you might have about ITR filing as a self-employed taxpayer. Armed with this knowledge, you might find it easier to ensure accurate submissions and optimal financial outcomes.

Start Watching

Season

TDS for Self employed Individuals

Welcome to TDS for Self-employed Individuals! These videos could help you clarify the essentials of managing your TDS effectively. Here, we will try to provide valuable insights into TDS deductions, rules, and online payment steps to ensure smooth tax compliance. You will be able to dive into understanding the basics of TDS on Fixed Deposits. We will explain how TDS could impact your interest earnings and guide you on claiming a refund if needed. Next, we will explain the inner workings of Section 194C. Our videos will cover TDS rules for contractor payments, including rates, conditions, and exemptions. This could help you keep your payments compliant and hassle-free. Finally, we will walk you through the e-Filing portal, from inputting your TAN to verifying and submitting your payment. Here, you will also understand the online TDS payment process to manage your taxes with ease. So, get ready to master these TDS essentials to ensure smooth sailing on tax waters.

Start Watching