Decoding the Credit Score Jargon: What Do Those Numbers Really Mean?

Confused about the three digits that make up your credit score? You’re in luck! In this video, we’re uncovering the factors behind your credit score and explaining what each component means for your financial health.

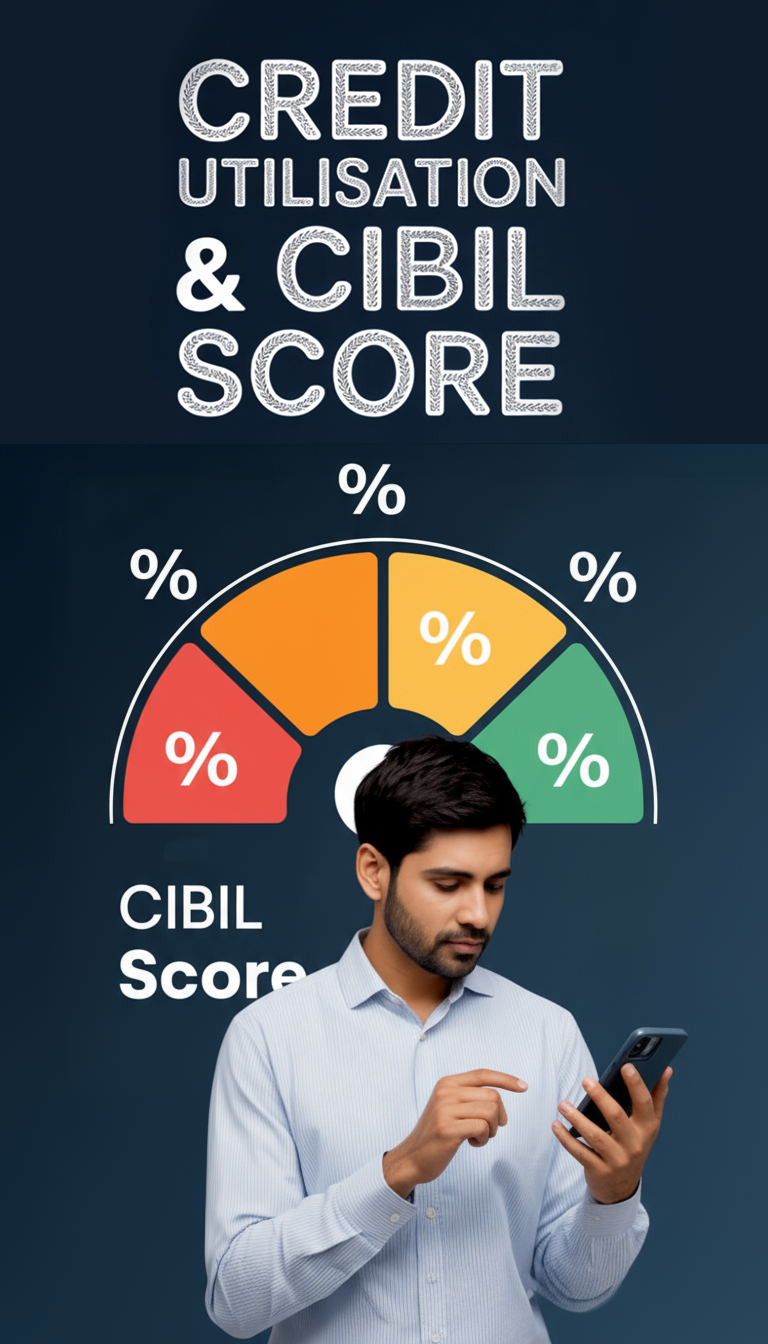

To start, we will explore payment history, one of the largest factors in determining your score. Consistent, on-time payments on credit cards and loans enhance your score, while missed payments can lower it significantly, showcasing your overall financial reliability. Next, you’ll learn about credit utilisation, or how much credit you’re using relative to your limit. Keeping utilization below 30% could signal responsible credit use.

The longer your credit accounts remain active and responsibly managed, the more positively it impacts your score. We’ll also cover types of credit and their effect. A mix – such as credit cards, loans, and mortgages – suggests balanced credit management. But remember, new credit should be added only when necessary.

Finally, we’ll walk you through tips to be mindful of, such as new credit inquiries, opening new accounts, etc. Understanding these elements empowers you to manage your credit wisely.

Remember, your score isn’t fixed; it grows with your habits. By regularly checking your credit report and using credit responsibly, you’ll pave the way to better financial health.

Key Takeaways

Your credit score reflects your financial behaviour, so pay on time and manage credit responsibly to boost it

Try to keep credit card balances below 30% of the limit for a healthier credit score

A long-standing credit history could demonstrate responsible financial habits and strengthens your score

A mix of various credit types could positively impact your score, but only borrow what you need

Opening too many new credit accounts quickly might raise concerns for lenders

Check your credit report regularly for accuracy and manage bills punctually

Understanding your credit score could empower better financial decisions and control

What to Watch Next

Bites