The Universe of Investments

Welcome to The Universe of Investments, where we’ll explore the diverse realm of financial opportunities. In this series, we’ll take you through the building blocks of investing, highlighting the key differences between saving and investing. We’ll also showcase the immense potential of compound growth over time.

We’ll look into popular investment avenues such as mutual funds, fixed deposits, and the National Pension Scheme. You’ll learn how to make the most of small budgets, set achievable financial goals, and strike the right balance between short-term and long-term investments.

Furthermore, we’ll discover the importance of diversification and how tools like SIP and FD calculators might help streamline your financial planning. Whether you’re new to investing or looking to expand your portfolio, The Universe of Investments could help you manoeuvre through the ever-evolving financial landscape.

5 Seasons

Season

About Investments

Welcome to About Investments, where we’ll traverse through the vast world of investment opportunities. In this season we’ll take you through a detailed exploration of India’s diverse investment options. This could offer a solid foundation if you’re looking to build wealth. We’ll delve into the psychology of investing, shedding light on how emotions influence financial decisions. You’ll learn how to set and achieve financial goals and understand the importance of crafting a diversified portfolio. Whether you’re debating between long-term and short-term investments or seeking tips for small-budget investing, this season has something for everyone. We’ll also explore critical concepts like SIPs, retirement planning, and the difference between saving and investing. You’ll discover how starting early could make all the difference in growing your wealth. With valuable tips and actionable steps, About Investments could empower you to make better decisions on your path to financial security.

Start Watching

Bites

Season

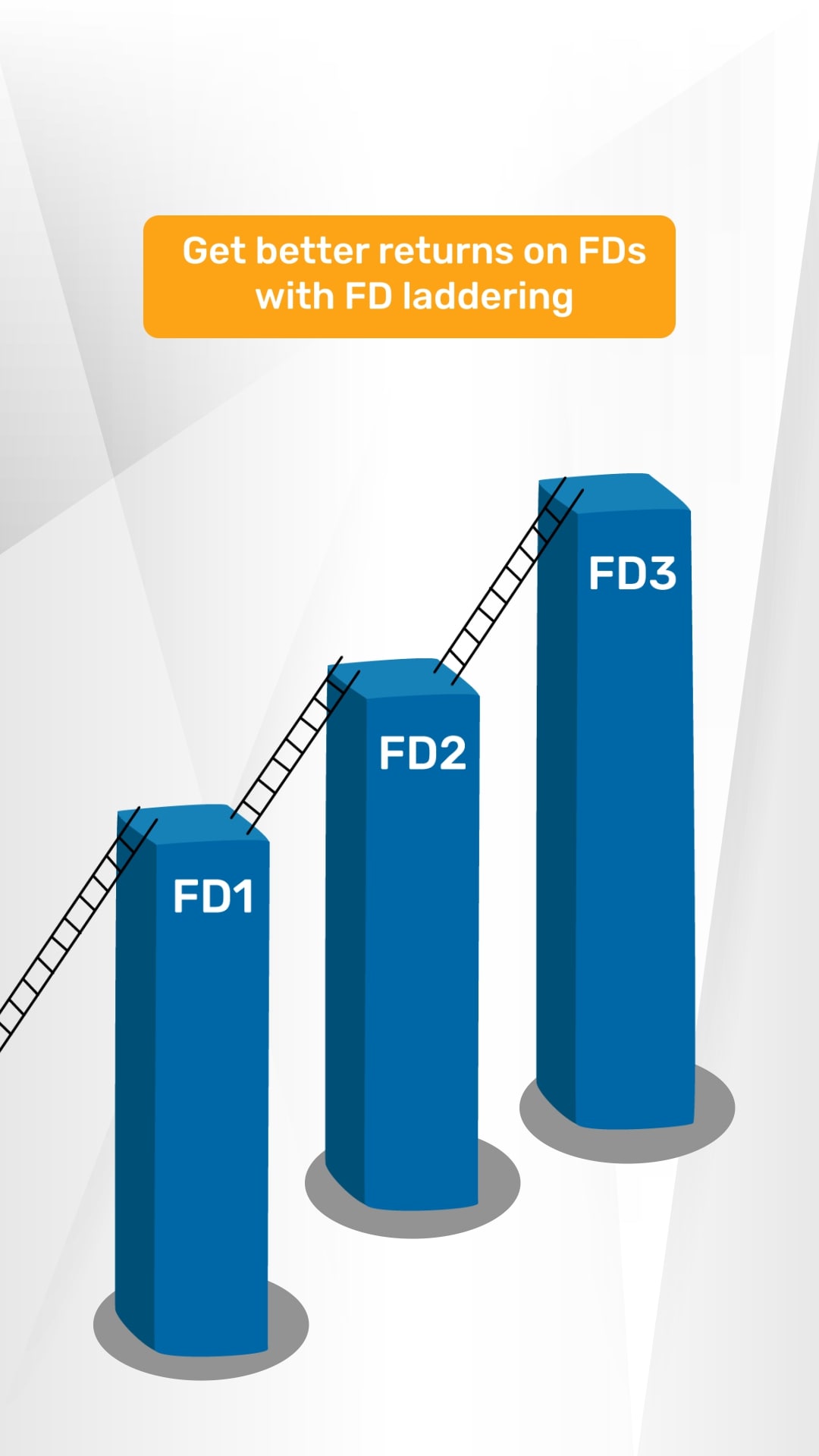

Fixed Deposits

Welcome to Fixed Deposits, where security meets financial growth. In this season, we’ll unpack the timeless appeal of FDs, from understanding the basics to implementing advanced strategies like FD laddering. This could offer greater flexibility and optimised returns. We’ll explore various types of FDs, including cumulative, non-cumulative, and tax-saving options, while highlighting their role in achieving your financial goals. You’ll learn how to avoid common pitfalls, make informed investment decisions, and use tools like FD calculators for better financial planning. We’ll also unravel the power of compound interest in growing your savings and the tax implications of FDs. You’ll understand how to leverage options like overdrafts and credit cards against your deposits. Whether you’re looking for steady returns or ways to achieve your financial milestones, this season could help you harness the power of FDs to pave the way.

Start Watching

Bites

Season

The National Pension Scheme Chronicles

Welcome to The National Pension Scheme Chronicles, where we’ll break down the essentials of investment strategies for a secure financial future. In this season, we’ll explore the National Pension Scheme or NPS and its potential as a dependable long-term investment. We’ll dive into the key features of Tier 1 accounts, tailored for retirement savings, and Tier 2 accounts, offering flexible investment options. We’ll also simplify the process of opening an NPS account, making retirement planning straightforward. Additionally, you’ll discover how the NPS calculator might help you estimate returns and optimise your contributions. Finally, we’ll shed light on withdrawal strategies, that might help you understand how to unlock your NPS savings when the time comes. Whether you’re starting your investment journey or fine-tuning your retirement plans, The National Pension Scheme Chronicles could equip you with valuable information to make well-informed monetary decisions.

Start Watching

Season

Mutual Funds 101

Mutual funds offer an accessible and diversified way for beginners to invest and grow their wealth. Understanding their basics is crucial for making informed investment decisions. Investors should try to align investments with their risk appetite and financial goals. Hence, it's vital to know about the different types of funds. Some of the most prominent types include equity, debt, and hybrid funds. The process of investing involves several steps. Decoding the various terms, fees, charges, and tax implications could make investing smoother. Investors must choose a fund and how they want to invest in it. They can make lump sum contributions or through systematic investment plans (SIPs). One must also be familiar with the key rules and regulations of mutual funds. In India, these are set by the Securities and Exchange Board of India (SEBI). These ensure that both investors and asset management companies follow fair investment practices. Plus, investors should avoid common mistakes and plan using the SIP calculator and lumpsum calculator. In this way, beginners can optimise their investments and build a diversified portfolio.

Start Watching

Bites

Season

Stepping into the Stock Market

Welcome to Stepping into the Stock Market! This season explores the basics that could shape how you view and understand the stock market. From decoding common jargon to knowing who manages your money, we’ve got the essentials covered. Tag along as we break down key concepts like stocks vs. shares and how stock markets differ from stock exchanges. Learn what Sensex and Nifty might indicate and why their movements could matter to you. You’ll also get a closer look at how primary and secondary markets function and what exactly gets traded there. This season brings you key insights into IPOs, FPOs, bull and bear markets, and more. Discover the various avenues where your money could be invested, from stocks and bonds to other market instruments. Uncover which market benchmarks might be worth tracking beyond Sensex and Nifty 50. Step in with an open mind and you might find that the world of stocks isn’t as complex as it seems!

Start Watching

Bites