Advanced Financial Strategies

Episodes

E01: Mastering Financial Alchemy Advanced Budgeting Strategies

03 mins

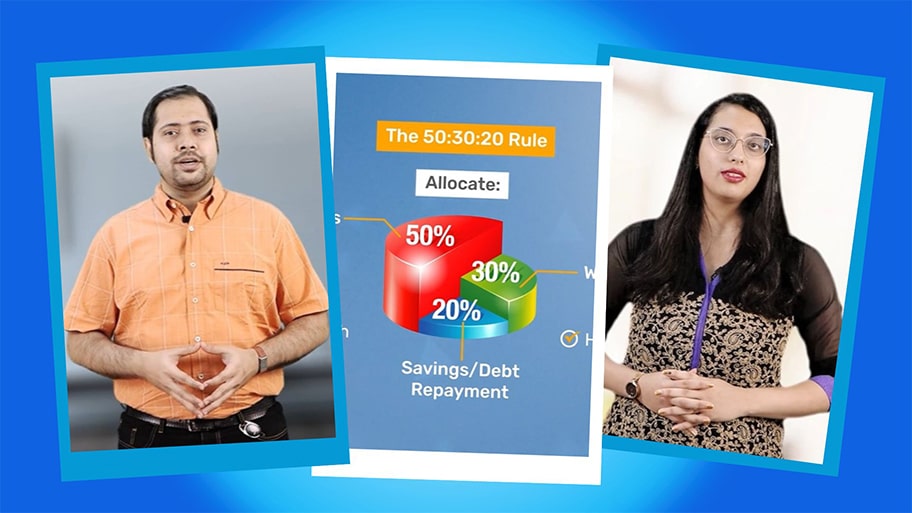

Budgeting is an ancient art of financial alchemy that could transform income into a powerful tool for achieving financial goals. In this video, we’ll explore advanced budgeting techniques that could help turn your financial challenges into opportunities. We’ll start with zero-based budgeting, where every rupee is allocated with purpose, and go all the way to the Envelope System, a simple yet effective method for managing expenses. These techniques might help you learn how to take full control of your finances. We’ll also dive into the classic 50:30:20 Rule, offering a balanced approach to spending, saving, and enjoying life. Additionally, we’ll cover a few modern strategies. Be it automated savings and investments, which might help you save effortlessly, or expense tracking apps for real-time monitoring of your spending. We’ll also look into annual budget planning that could provide a broader perspective and help you prepare for irregular expenses throughout the year. We’ll highlight the importance of emergency fund planning and explain the debt snowball and avalanche methods. This could help you safeguard against financial surprises and tackle debt. By mastering these techniques, you could unlock the secrets of financial success and pave the way for a secure future.

E02: From Wallet to Palate Decoding Eating Expenses

03 mins

India's rich culinary landscape offers diverse dining experiences, each with its own costs and benefits. Understanding these options could help you make better financial and lifestyle choices. In this video, we’ll break down the expenses associated with eating out, ordering in, and cooking at home. Eating out could range from affordable fast-food options to expensive fine dining. Quick meals might cost around Rs. 200-300 per person, while fine dining could exceed Rs. 5,000 for two. We’ll also explore the growing trend of food delivery, where hidden costs like delivery charges, service fees, and taxes might inflate the bill. It could turn a Rs. 800 meal into a Rs. 1,000 one or more. Cooking at home could offer a cost-effective and healthier alternative. We’ll discuss grocery costs, utility expenses, and the overall savings of home-cooked meals. While it requires effort, cooking could foster healthier habits and allow for culinary creativity. By evaluating these choices, you could decide which dining option aligns best with your budget and preferences, balancing convenience and cost. This might help you uncover the true cost of your meals and optimise your dining choices!

E03: How Can Estate Planning Help You

03 mins

Estate planning could be essential to ensure your assets are managed and distributed according to your wishes. In this video, we’ll explore why estate planning matters and how it could help protect your family. Firstly, we’ll look at how it might prevent family disputes by providing clear instructions on asset distribution, reducing the likelihood of conflicts. Estate planning could also save time and money by avoiding lengthy court procedures and unnecessary legal fees. Additionally, it could ensure your wishes are honoured, whether it’s about dividing assets or appointing guardians for minor children. We’ll then dive into the key components of estate planning. This includes a will, which outlines how your property should be distributed, and trusts, which could help manage assets for beneficiaries like minors. A Power of Attorney allows a trusted person to make financial or legal decisions on your behalf if you’re incapacitated. A living will specifies your medical treatment preferences. Lastly, inheritance laws that might help align your plan with legal requirements. Estate planning isn’t just for the wealthy. Anyone, irrespective of wealth and age could consider having an estate plan. This might help ensure your family receives your assets without any issues.

What to Watch Next

All