Do You Know What's Written in Your CIBIL Report?

Hello! Ever wondered what details are in your CIBIL Report? Let’s dive into a full breakdown in this video.

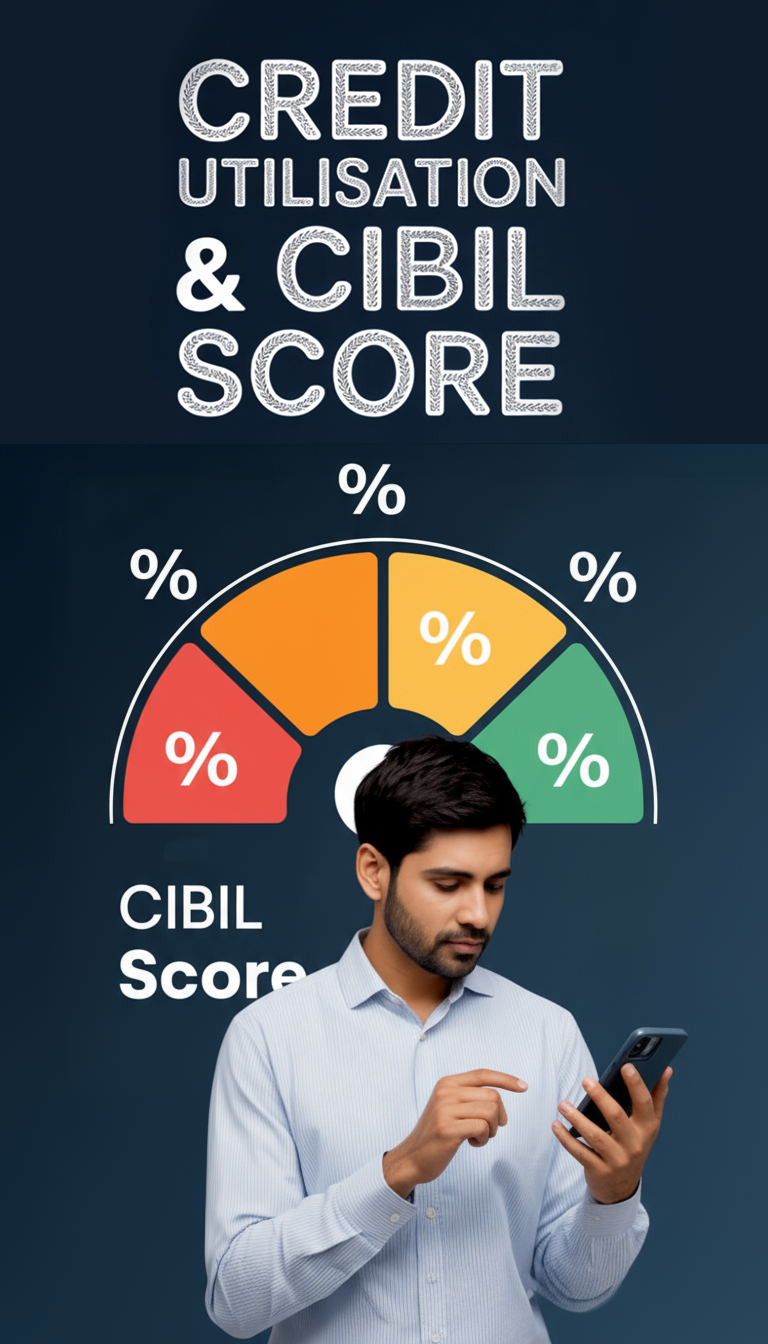

First up, we’ll look at to the CIBIL Score section, where your credit score appears, typically ranging from 300 to 900. If you see “NH” instead, it just means you have limited credit activity or only add-on credit cards.

Next, you’ll learn about the Account Information section, where you’ll find various details about your loans and credit cards. Remember, if a yellow box shows up, it signals a section under dispute. After that, we’ll explore the Profile Information section. It houses personal details, like your name, date of birth, official ID numbers and your contact details.

Thereafter, we talk about Employment Details. Here, you’ll see your occupation and income, based on your credit applications. Lastly, the Enquiry Information section lists lender inquiries for credit applications, with details like lender name, date, and loan type.

Finally, you’ll discover some key CIBIL Report terms. These include the Control Number (a unique report ID for disputes), DPD (Days Past Due), Cash Limit (cash you can withdraw on credit), and so on.

And there you have it! Now you’re all set to read your CIBIL Report like a pro!

Key Takeaways

Your CIBIL Score, ranging from 300 to 900, reflects your creditworthiness to lenders

The Account Information section provides insights into your loan and credit card accounts

A yellow box highlights disputed sections in your CIBIL Report

Profile Information and Contact Details sections contain your personal and contact information

The Employment Details section shows your occupation and income information

The Enquiry Information section shows lenders' inquiries for credit applications

Understanding terms like Control Number, Cash Limit, and Credit Limit is crucial to interpret your CIBIL Report accurately

What to Watch Next

Bites