Credit Scores Unleashed: How Your Score Can Impact Your Everyday Life

Did you know that your credit score has an impact on your daily life as well? In today’s video, we’re taking a deeper look at how credit scores impact our daily financial choices. The extent of their influence might surprise you!

Let's start with home loans. A high credit score could make you an appealing candidate for lenders, unlocking favourable interest rates and simplifying the process of getting a home loan. On the flipside, lower score might mean higher rates, making the journey to homeownership more challenging.

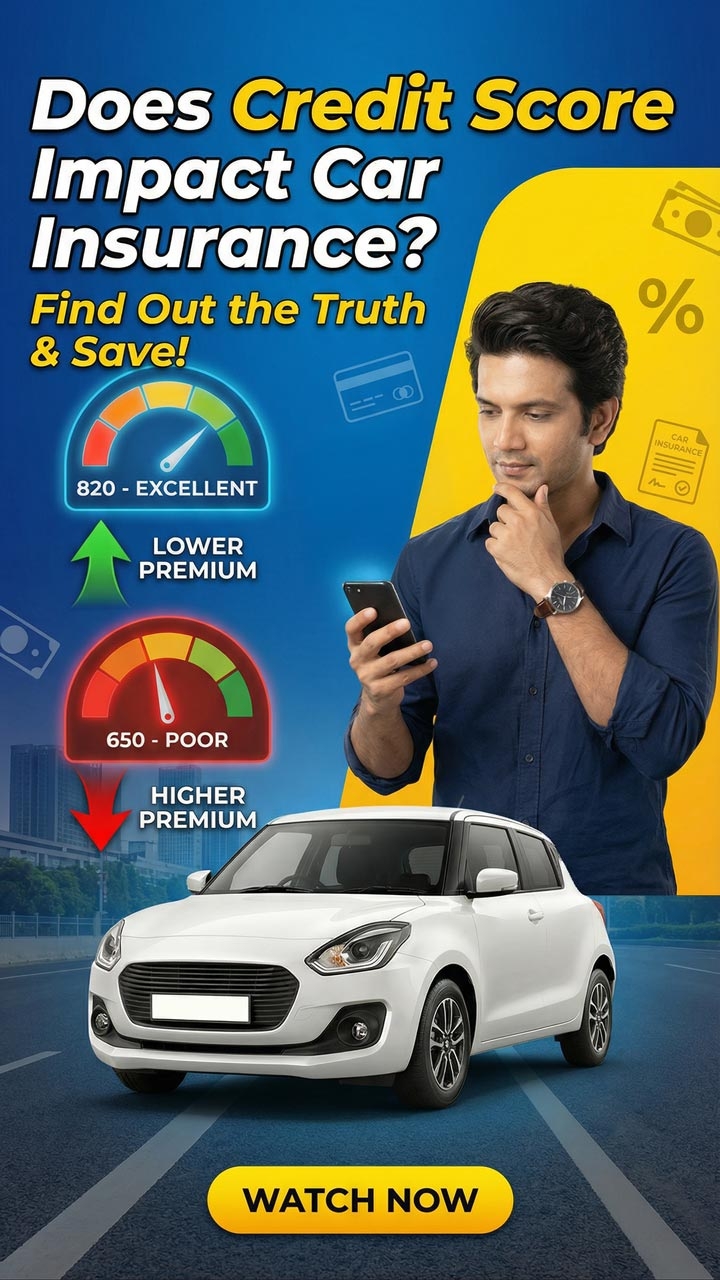

Now, moving on to vehicle loans. Here, we’ll learn how your credit score could affect the affordability of your dream car. While good score could open options for lower monthly payments, a lower score, could lead you staring down higher costs.

Next, we’ll consider credit cards. A robust credit score can qualify you for premium credit cards with added perks, while a low score might limit you to basic cards. The video will take you through how a good score could fetch you travel benefits, cashback, and more.

By understanding and improving your credit score, you set yourself up for more choices and a smoother financial path in life.

Key Takeaways

A good credit score could help you secure favourable home loan interest rates and approval

Vehicle loan options and interest rates could also be influenced by your credit score

A fine credit score could play a vital role in securing premium credit cards with better perks and lower fees

Mr. and Mrs. Sharma's smooth home-buying journey showcases the perks of maintaining an excellent credit score

Riya's lower interest rate on her vehicle loan, thanks to her stellar credit score, contrasts with Rayan's higher rate due to a lower score

Aman's premium credit card with rewards highlights how a good credit score could open doors to better financial opportunities

Rahul's struggle to get a credit card emphasises the limitations that one could face with a lower credit score

What to Watch Next

Bites