Credit Scores and Loan Approval: Navigating the Credit Landscape for Borrowers

The importance of credit scores in debt applications cannot be overstated. This video will help you gain essential insights into building and maintaining a good credit score for smooth loan approvals.

In India, credit scores range from 300 to 850, calculated by bureaus like CIBIL, Experian, and Equifax. We will start by explaining how this is influenced by your credit history, repayment habits, and financial behaviours. Lenders view credit scores as a snapshot of your creditworthiness. A high score often leads to faster approvals, while a lower score may cause lenders to scrutinize or even reject applications.

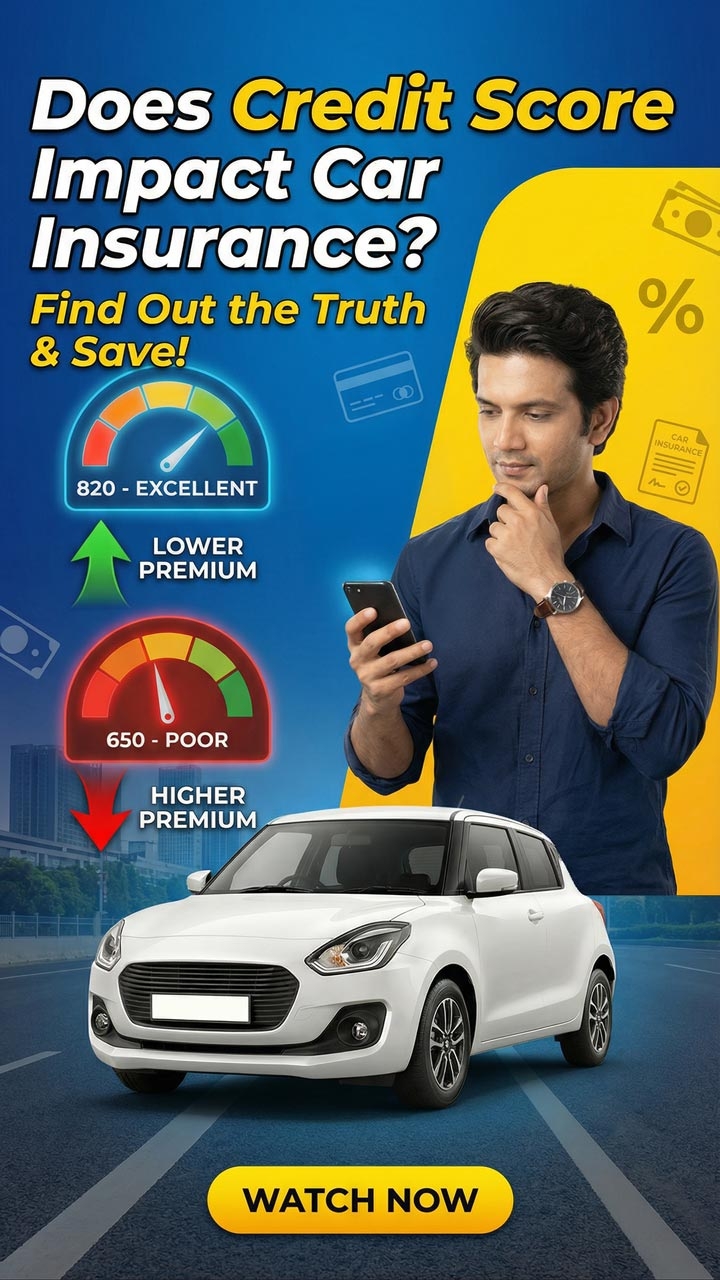

You will also learn how different loan types are affected differently. For secured loans, like home or car loans, lenders may accept a slightly lower score due to the collateral. However, unsecured loans, like personal loans or credit cards usually require higher scores.

The video will also discuss how your credit score also influences interest rates. Higher scores can yield lower rates, while lower scores may result in higher interest. Finally, we will explore possible ways to secure loans on favourable terms by maintaining a strong credit score by paying bills on time.

Understanding how credit scores shape your loan opportunities is key to a stable financial future. Stay tuned for more tips!

Key Takeaways

Credit scores influence loan approvals and interest rates, showcasing your financial reliability to lenders

Secured loans like home or car loans can have more flexible credit score requirements due to collateral

As unsecured loans like personal loans or credit cards don’t have any collateral, they could require a better credit score

Maintaining a high credit score could save money by attracting lower interest rates over the loan period

Responsible financial habits, like timely bill payments and managing debt, could improve your credit score

Regularly checking credit reports for errors is crucial to avoid negative impacts on your credit score

Seeking professional credit counselling can offer valuable guidance in improving credit scores and managing finances effectively

What to Watch Next

Bites