Credit Score and Beyond: How Financial Habits Shape Your Overall Financial Health

Ready to uncover the broader landscape of personal finance beyond the credit score? Join us as we dive into this vital topic in this video to boost your financial health!

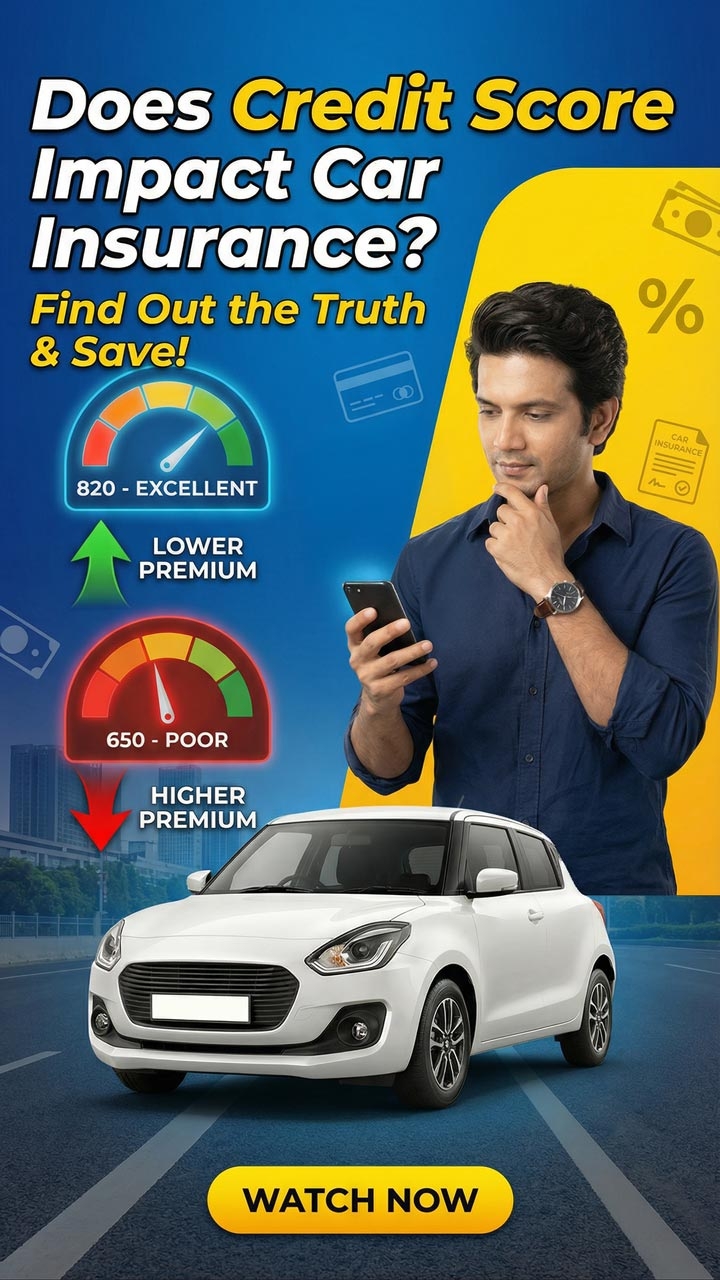

Firstly, we’ll show you how a credit score, despite being a measure of your creditworthiness, is only one piece of your financial health puzzle. Good financial habits extend much further, helping shape a stable and prosperous future. You’ll understand how your credit score could impact loan terms, insurance premiums, rentals, and even job prospects. After all, everything tends to come under influence of your payment history, credit utilisation, and length of credit history.

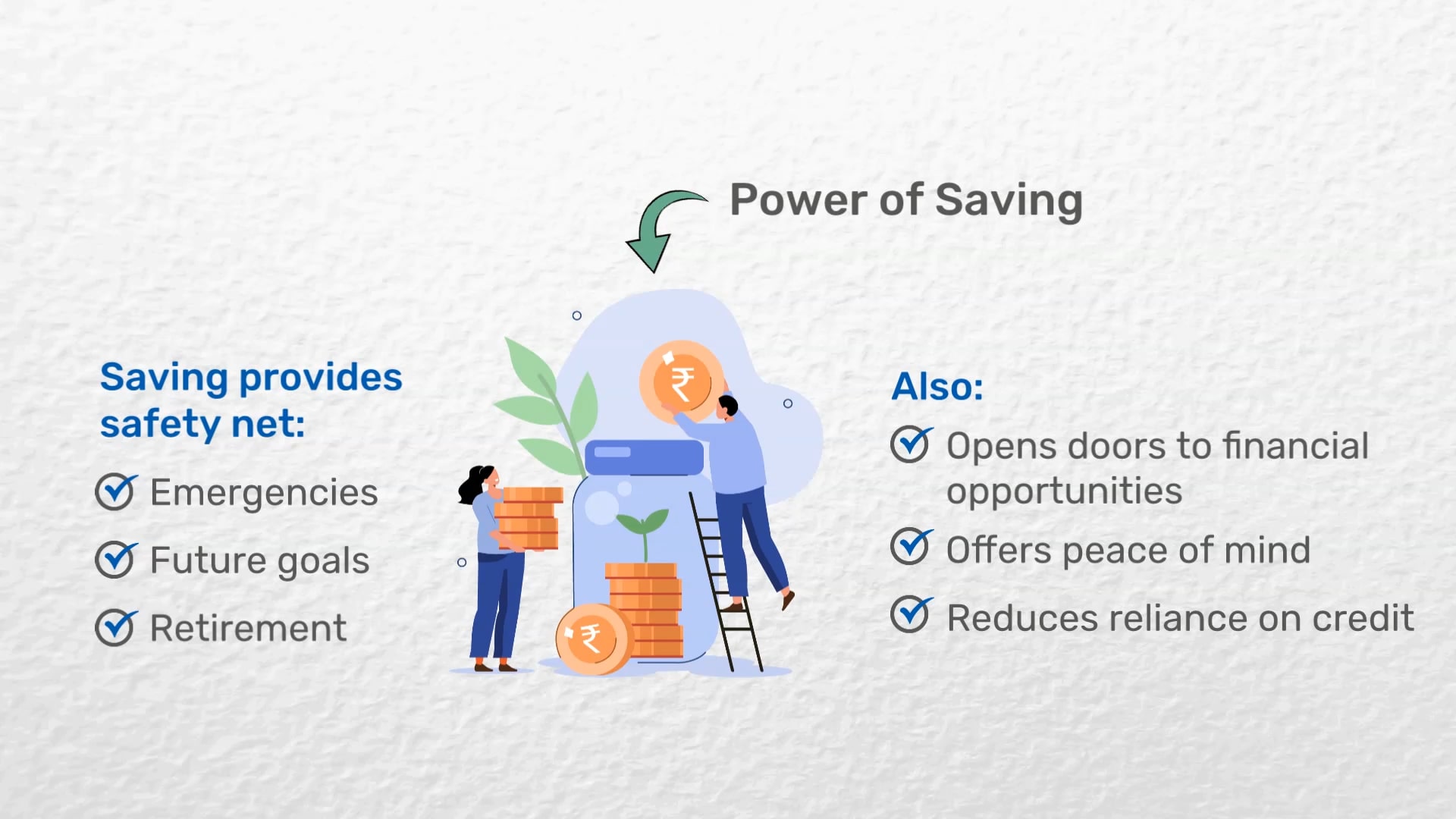

This video will also show you that building a strong foundation includes budgeting, saving, and investing. Budgeting goes beyond tracking expenses—it’s about empowering yourself to allocate wisely, prioritise goals, and avoid debt. Savings are essential for peace of mind and a safety net during unexpected expenses. Moreover, you’ll learn that investing fuels long-term growth, building assets over time. Finally, we’ll provide pointers to help reduce high-interest debt to improve financial well-being.

In essence, a high credit score is valuable, but sound financial habits complete the picture. Join us as we build resilience and success in our financial journeys.

Key Takeaways

Some factors that could influence your credit score include payment history, credit utilisation, credit history length, and types of credit

A good credit score could affect not only loan approvals but also insurance, rentals, and job opportunities

View your financial health comprehensively by cultivating habits like budgeting, saving, and investing

Budgeting isn't just tracking expenses; it's a tool to help you allocate resources wisely and avoid unnecessary debt

Saving is crucial for emergencies, future goals, and retirement, providing a safety net for unexpected expenses

Investing intelligently for long-term financial growth by building assets is key to building a strong financial future

Recognise the difference between good and bad debt, and formulate a strategy to minimize high-interest debt

What to Watch Next

Bites