How to Make Declarations When Filing Income Tax: A Step-by-Step Guide

When filing your taxes as a salaried employee, there are several key components to declare. Let’s walk you through them.

First, we’ll talk about the components of your salary that you need to disclose. These include your basic pay, allowances, bonuses, and any other perks. Next, you’ll learn all about declaring your investments. These cover your investments in ULIPs, PPF, NSC, etc., that you can claim deductions under Section 80C. Don’t forget, NPS contributions are also eligible for tax benefits under Section 80CCD.

After that, we come to other deductions like healthcare expenses. For example, premiums paid for health insurance can be deducted under Section 80D. Next up, the video will take you through deductions that you can claim for your housing costs. There are exemptions on House Rent Allowance under Section 10(13A) and home loan repayments under Sections 80C, 80EE, and 24(b).

Ready to learn more? Then let’s venture into perks like Leave Travel Allowance (LTA). If your employer offers LTA, you can claim tax benefits on travel expenses for you and your family. Moreover, your donations to registered charities can also be eligible for deductions under Section 80G.

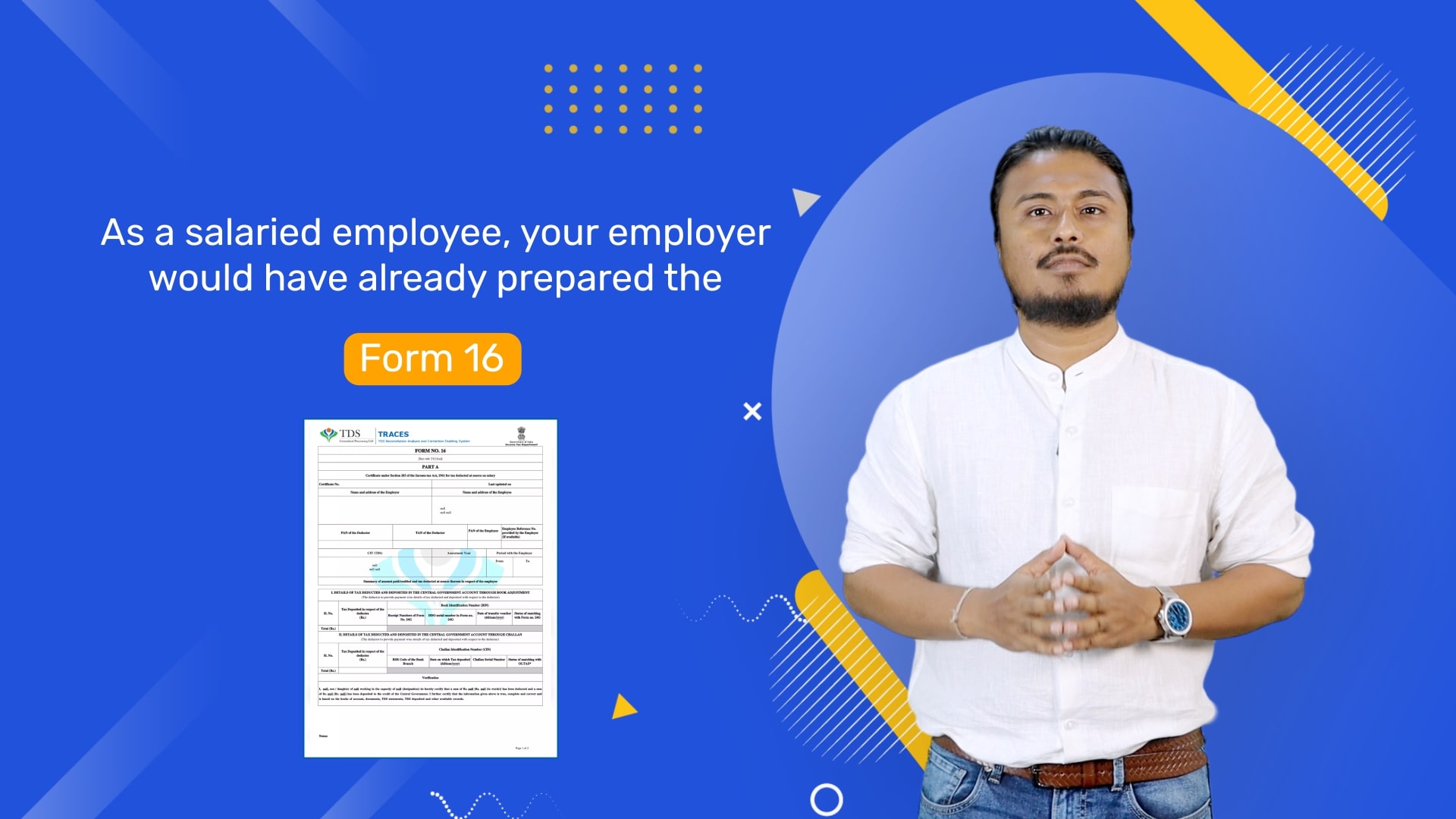

Lastly, we’ll also discuss important documents to keep handy for a smooth tax filing experience.

Key Takeaways

Declare your total salary, including basic salary, allowances, bonuses, and prerequisites, based on your salary slip

Utilize Section 80C for deductions on investments like ULIPs, PPF, EPF, NSC, and premiums paid for life insurance

Save for retirement with National Pension Scheme contributions and claim deductions under Section 80CCD

Gain tax benefits on health insurance premiums by declaring medical expenses under Section 80D

Leverage tax advantages related to housing, such as HRA for rented accommodation and deductions on housing loan interest and principal [Sections 10(13A), 80EE, 80C, and 24(b)]

Claim deductions for Leave Travel Allowance (LTA) and charitable donations under Sections 10(5) and 80G respectively

Stay organized and use online tools for efficient tax filing

What to Watch Next

Bites